Indiana allows a small estate affidavit to shield eligible heirs from probate in the event of a death without a will. Bank accounts and other estate assets can typically be claimed by beneficiaries of a minor estate more quickly and affordably than through probate. This quick administration procedure is only available in Indiana if the estate has a value of less than $100,000 and the death occurred at least 45 days ago. Real estate-related estates may be settled using this procedure following a court request for authorization. Speak with a financial professional who can assist you with estate planning. You will learn about the requirements, and advantages, of small estate affidavit Indiana and its form in this article.

What Is a Small Estate Affidavit in Indiana?

A small estate affidavit is a sworn legal document that can be used by an heir to claim assets from the estate of a deceased individual. The assets must be transferred to the qualified recipient upon presentation of the small estate affidavit to a bank or other organization managing the deceased’s estate.

By employing this quick administration procedure, the heirs can avoid probate, which can take months or years and include paying charges that significantly reduce the value of the estate. However, not every estate in Indiana qualifies for this process. For minor estates, affidavits need to specify:

- The estate has a less than $100,000 value.

- The death occurred at least 45 days ago.

The small estate affidavit procedure must be used to petition the court for permission to transfer real estates, such as a home and other real estate if the estate contains such property.

It is not necessary to file the small estate affidavit with the court in Indiana. To release estate assets, a completed affidavit can be given to the bank, entity, or individual in possession of them.

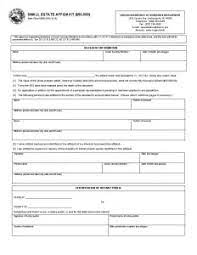

You can download the Indiana small estate affidavit form from their website. An even simpler-to-use form can be downloaded from Indiana Legal Help. Most folks don’t need legal assistance to form and complete the affidavit. Although notarization of the form is not legally required, it is advised that a notary witness certify the signatures.

Indiana Small Estate Affidavit Requirements

A small estate affidavit, according to Indiana law, requirements include:

- Give the decedent’s name, address, Social Security number, and the day of their passing.

- Declare that the estate’s assets are worth less than $100,000.

- Declare that the death occurred 45 days ago.

- Declare that no request for the appointment of a personal representative has received approval.

- Provide the full name and address of all the beneficiaries of the estate’s assets, together with the share of the account that each will get.

- Declare that every person included in the affidavit is aware that it is being used.

- Be executed in front of a notary public.

Indiana Small Estate Affidavit: Advantages and Disadvantages

Notable advantages of small estate affidavits include:

- In comparison to formal probate, it takes less time.

- Probate is far more expensive than this.

- When someone passes away without a will, they can file a minor estate affidavit.

Disadvantages include the following:

- Estates had to be worth less than $100,000.

- All eligible beneficiaries and heirs must provide their consent before using the affidavit.

- Transfers of real estate require judicial approval.

Small Estate Affidavit Indiana Form

When a decedent has few assets, they employ an Indiana small estate affidavit form. An estate must be worth less than $50,000 in Indiana to qualify as a minor estate. The assets of the deceased, including stocks and bonds, checking and savings accounts, safe deposit boxes, real estate, and personal belongings, may be gathered.

How to fill out the Small Estate Affidavit Form in Indiana

To begin, enter the decedent’s information in the affidavit’s opening. This contains the name, social security number, date of death, and residence at the time of death of the deceased. Write the affiant’s name below and ensure that the estate is valued at less than $50,000 and that the decedent’s passing occurred at least 45 days ago.

Then, fill out or include a list of all the heirs, their residences, and the corresponding inheritance shares to which they are due. Then, the affiant will provide their entire address, date of birth, and social security number, and sign and date the affidavit.

FAQs

In Indiana, how does a small estate affidavit operate?

The small estate affidavit need not be submitted to the court in Indiana. The bank, organization, or person in possession of the assets may receive an affidavit to release the estate’s assets. You can download the Indiana small estate affidavit form from their website.

What is an Indiana devolution affidavit?

The estate attorney may be able to utilize a devolution-type affidavit to demonstrate the legal transfer of ownership from the deceased to their heirs as a matter of law without having to use the probate system, provided that there are no other competing statutes or regulations.

In Indiana, who is authorized to sign a small estate affidavit?

The inheritor may file the Indiana Small Estate Affidavit (Form 54985). Furthermore, the inheritor shall notify every other inheritor of their plan to submit this affidavit to the court. It is possible to use this process for things like giving the inheritor the title to a vehicle.

What is Indiana’s small estate threshold?

In many cases, it can do away with the requirement for probate administration. Under this process, an heir or administrator may use an Indiana small estate affidavit to collect and distribute assets of a dead person who left behind probate assets worth $100,000 or less.

Conclusion

In Indiana, a small estate affidavit can help with asset transfers from a deceased person’s estate while also saving money. The affidavits, however, are only applicable in cases where the estate costs at less than $100,000. Heirs can take possession of assets like stocks and bank accounts by completing a simple estate affidavit and presenting it to the estate holder. Most folks don’t need an attorney to complete one of these affidavits.