A tractor bill of sale form is a written document that details the sale of a tractor, gathers relevant information, and attests to the legitimacy of the agreement with signatures from the two parties at the end. In this post, I’ll go into greater detail regarding the tractor bill of Continue Reading

Business Law

Tax Consequences of Transferring Property to an LLC: What You Need to Know

Tax Consequences of Transferring Property to an LLC: Establishing an LLC can safeguard your assets and provide you with some pleasant tax benefits, but make sure you are aware of any potential tax ramifications before completing the transfer. What particular tax ramifications come with transferring an existing property into an Continue Reading

Liquidated Damages Real Estate: What You Need to Know

Most real estate transactions follow a structured process to meet the needs of both the home seller and buyer. If everything goes according to plan, everyone wins.When something goes wrong in the transaction, though, it might lead to differences between the parties and possible harm. Real estate brokers and transaction Continue Reading

SB 553: Definition, Importance, Requirement, and Law Applicable

Senate Bill (SB) 553, California’s new law aimed at preventing workplace violence, has several complex requirements for California-based firms. Attend this webinar to learn about the legal requirements for investigations, written plans, training, recordkeeping, and other topics. We’ll talk about how these employer responsibilities relate to risk management, safety procedures, Continue Reading

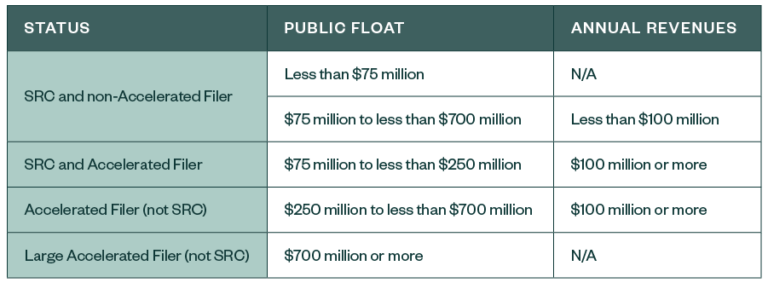

Large Accelerated Filer: Definitions, Amendment

The U.S. amended the Securities Exchange Act of 1934 and Rule 12b-2, defining “accelerated filer” and “large accelerated filer.” Securities and Exchange Commission (“Commission”) through a vote on March 12, 2020. The amendments aim to protect investors, promote capital formation, and reduce compliance costs for smaller issuers while preserving capital. Continue Reading

California Labor Code Section 2802: Meaning, Requirement

It is essential for managers and business owners operating in California to be aware of California Labor Code Section 2802. Like any other legislation, it may not make sense at first. However, you may ask, What does it mean? Don’t worry—we’ve got you covered! We thoroughly examined California Labor Code Continue Reading

Bear Hug Finance: Business Definition, Reasons, Pros and Cons How and Why It Happens

A hostile takeover tactic known as a “bear hug” occurs when a prospective buyer agrees to pay more for the stock of a target firm than it is truly worth. This tactic removes rivalry and makes it more difficult for the management of the target company to turn down the Continue Reading

Spell Businesses: Which Spelling is Correct and What is the Difference?

Even with all the efforts made by specialists to make languages more user-friendly, English is still a work in progress. One of the hardest ideas in English to grasp is “possessives,” as there are so many subtleties and nooks that a general explanation is insufficient to cover. More specifically, it Continue Reading

How to Start a Non-profit Organization

“How to start a non-profit organization” You have a fantastic concept for a new nonprofit organization that will make a significant difference in your neighborhood. The only difficulty is that you lack initial funding. Is it even feasible to establish a nonprofit with no funds? The quick answer is yes! Continue Reading

Can You Sue Insurance Companies?

The rate of the questions “Can you sue insurance companies,” how to sue insurance companies for denying claims, for emotional distress? and many others are increasing daily. However, Insurance is essential in many aspects of a person’s life. Because there is such a high demand for Insurance, the insurance sector Continue Reading