Crummey trusts are a helpful estate planning strategy for wealthy people who want to reduce their gift and estate taxes. Although it isn’t meant to be employed, the Crummey power gives the trust’s beneficiaries the ability to remove assets. Rather, its purpose is to allow presents that aren’t eligible for the annual gift tax exclusion. Beneficiaries receive an explanation of this through a Crummey letter or notification. You must comprehend the meaning of any letter you receive.

Let’s dive in to know all about Crummey’s letter.

What Is Crummey Letter?

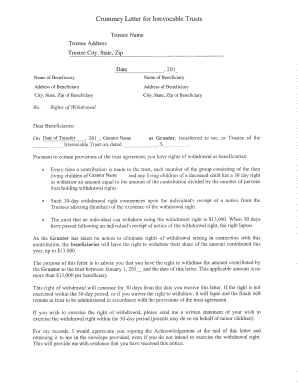

Written documentation outlining the conditions of the Crummey power being granted to the beneficiaries is known as a Crummey letter or Crummey notice. All beneficiaries of the trust must receive a Crummey notification from the IRS, and some guidelines must be followed:

- When gifts are made to the trust, a notice has to be issued to the beneficiaries.

- The precise amount of the contribution must be stated in the Crummey letter.

- The beneficiaries must be informed in writing that they have the right to withdraw gifts made to the trust and that this right is effective right away.

- How long they have to exercise the option to make a withdrawal must be specified in the notice.

- Beneficiaries must be informed in Crummey letters that all assets will stay in the trust if they choose not to exercise their entitlement.

The trustee is in charge of creating the Crummey notice and seeing to it that copies are distributed to each beneficiary of the trust. According to IRS regulations, a gift is not deemed “completed” without this notification. The annual gift tax exception does not apply to a donation that is not completed.

This is what a Crummey letter is incapable of doing. It cannot convey to the beneficiary in any manner—explicitly or implicitly—that they are unable to withdraw funds from the trust within the allotted time limit. The gift tax deduction is not applicable if the notice implies in any way that beneficiaries are unable to use their Crummey power.

A Crummey Trust: What Is It?

Crummey trusts are useful estate planning instruments for high-net-worth individuals seeking to minimize estate and tax liabilities. Crummey trusts can reduce taxes for those with larger estates. Funds within the trust may be utilized to qualify for the annual gift tax exemption.

This authority gives the beneficiaries the ability to remove assets from the irrevocable trust. On the other hand, using the power is not intended. Rather, the goal is to qualify an ineligible present for the annual gift tax exemption.

The donations must also represent a present interest to be eligible for the annual gift tax exemption. The Crummey Trust can be established with a clause allowing beneficiaries to access assets within a specific

time frame. For example, you may grant them access to assets within a month of the trust’s creation.

The annual gift tax exclusion becomes operative only upon the receipt of a Crummey letter in compliance with IRS regulations. You will not have your taxable estate reduced upon your death if those criteria are not followed.

How to Respond to a Crummey Letter

There isn’t anything you need to do if you receive a Crummey notification as the beneficiary of a trust. It’s also advisable to save a copy of the letter for your records, as there’s no need for additional actions.

Naturally, it is presuming that you have no intention of taking any of the trust’s assets out. What happens, though, if you wish to cash out?

In that scenario, you would afterward need to contact the trustee and inform them of your plans. It is your responsibility to inform them of the amount you wish to withdraw, and the trustee will make sure the funds reach you.

If additional gifts are being made to the trust, you may receive multiple Crummey notices. The trustee is also required to send one asset out every time assets are added. Again, though, if you have no intention of withdrawing from the trust, you are under no need to do anything with these letters.

If you’ve received a contribution to a trust without receiving a Crummey letter, you might need to discuss potential rights violations. You can also speak with your financial advisor or an estate planning attorney. The trustee is obliged to inform you that you can withdraw funds, even if you don’t intend to do so.

Drawbacks of the Crummey Trust

A possible disadvantage of the Crummey Trust is that giving recipients—especially minors—immediate access to substantial gifts could compromise the fund’s capacity to grow its assets over time. Some families get around this by imposing restrictions, such as capping the amount or frequency of withdrawals or ceasing to give future gifts to beneficiaries who take money out right away.

For instance, a parent may stipulate that their child cannot access trust funds until they become 25. However, the receiver can only access the most recent contribution, even if they choose to use the trust right away. Every gift from the past is still safe in the trust account.

FAQs

What Occurs if Crummey Letters Are Not Sent?

Invalidity of Trust: The validity of the trust may be jeopardized if Crummey letters are not sent. The planned tax benefits of the trust may be nullified if the IRS finds that the trust’s operations do not follow the Crummey principles.

Can I Email Crummey Letters?

All current beneficiaries may get the Crummey notices through electronic mail, or email. Should your trustee choose to take this action, he or she ought to ask the recipient to send back an email acknowledging receipt.

What Does an Ilit Aim to Accomplish?

Individuals can guarantee that the proceeds from a life insurance policy can escape estate taxes and follow the insured’s interests by setting up irrevocable life insurance trusts (ILIT).

Summary

When transferring assets to their heirs, richer people might reduce gift taxes by using Crummey trusts. The Crummey letter is a straightforward document, but its significance should not be understated because its delivery and wording determine whether or not the recipient is eligible for gift tax exclusions.

Also, Read