A broker of record, or AOR, is another name for an organization that has the legal power to act as an insured party’s representative and oversee an insurance policy.

It acts as a go-between for the insurance company and the policyholder. The following duties could be assigned to an agent of record:

- Managing modifications and renewals of policies

- Submitting a claim

- Settling disputes through negotiation

- Acting as the insured’s point of contact with the insurance provider

AORs can also assess and choose among a company’s benefits for employees, including retirement plans, health insurance, and life insurance.

A business may also collaborate with an AOR to handle the regulatory and administrative facets of its foreign contracts, such as payment and guaranteeing adherence to regional tax laws.

Why Do Businesses Employ Aor Services?

Businesses commonly use AORs to manage and oversee their insurance policies. It also helps businesses with benefits packages, particularly if they have spread workers with various global benefit requirements.

AORs assist multinational corporations in navigating the intricacies of engagement contracts. It guarantees adherence to contractor categorization, reduces legal and financial risks, and offers administrative support because contractor regulations differ between nations.

Employers looking for a third party to manage their distributed workforces across international boundaries sometimes collaborate with employers of record (EOR) to handle all HR and employment duties because an AOR does not take on a company’s legal or financial liabilities.

Advantages of Using a Record Agent

Among the many advantages of having an agent of record are the following:

- Proficiency. Based on the particular requirements and workforce of a business, it also offers analysis and makes recommendations about insurance, perks, and policies. It manages all problems, claims, and disputes on behalf of a company in all insurance-related concerns.

- Savings in terms of money and time. It saves businesses time on insurance-related administrative work by using its experience to identify the most affordable coverage and employee benefits. This enables businesses to concentrate more on operations and expansion.

- The act of representing. It works with the insurance provider directly, negating the necessity for the latter. It argues and represents a firm in negotiations, claims, or disputes to make sure the business gets a just result.

- Observance. Businesses can rest easy knowing that their insurance coverage conforms with local laws when they have an AOR. It oversees insurance policies in the best interests of the company and its employees.

Disadvantages of Using a Record Agent

Working with an agent of record has benefits, but there are drawbacks as well, such as the following:

- Restricted choices. Because they frequently only work with particular insurance companies, working with an AOR may limit your options as an insurance provider. A company’s capacity to select market-competitive prices may be impeded by an AOR partner.

- Increased expenses. Due to limited offerings, companies working with an AOR may have to pay more for insurance coverage and may incur additional fees from the AOR. The AOR may impose costs for the insurance company’s unpaid premiums if a company ends an agreement in the middle of the policy term.

- Restricted coverage. An AOR might suggest an insurance plan that falls short of what a company needs and offers insufficient coverage.

- Excessive reliance. Businesses that depend on an AOR to supervise all insurance-related choices may not have the best grasp of their insurance requirements, which could result in oversights and poorly thought-out judgments.

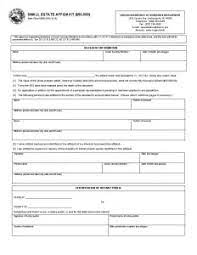

What Is an Agent of Record Letter?

A formal appointment of an insurance agent to represent a company is made through the use of an agent of record letter. A business seeking to terminate an existing AOR and replace it with a new agent of record must obtain an AOR letter.

When negotiating with insurance companies, the agent of record is granted power by the AOR letter to act on behalf of the company and function as a liaison. With the help of the letter, the agent of record can manage policy details, negotiate rates and coverage, handle all correspondence with insurance providers, and administer benefits.

Names of the company, carrier, policy number, and effective policy date are usually included in an AOR.

What Is the Procedure for the AOR?

When a business chooses to collaborate with a certain agency, the AOR process starts. An AOR letter is sent by the new agent of record for the business to examine and sign. After receiving the letter from the company, the agent of record forwards the signed AOR letter to the insurance company.

Usually, the new insurance coverage transfers in five to ten days. Once the letter is accepted by the insurance provider, the new AOR relationship formally starts. Additionally, if the business designates a new agent of record instead of an existing AOR, this acceptance automatically ends the previous arrangement.

A corporation can make the initial signed AOR void by signing a rescinding letter within the five to ten-day term if it decides to change its mind. To end the old one, the corporation must sign a new AOR letter with a different agent after ten days.

Before signing, companies should carefully review the AOR letter to make sure they are entering into an agreement that meets their specific needs.

When Would It Be Necessary to End an AOR Letter?

For a variety of reasons, a company may alter its AOR and terminate an AOR letter, including the following:

- The present AOR handled a task improperly or did not live up to expectations.

- The business is dissatisfied with the AOR’s communication or services.

- The business is looking for an AOR with additional industry experience.

- The business is looking for an AOR with market access.

FAQs

In Canada, what is an AOR?

An official document that attests to the receipt of your application by Immigration, Refugees, Citizenship Canada (IRCC) is called an Acknowledgment of Receipt. Check your eligibility for immigration to Canada.

What is AOR?

A business or individual with the legal right to act as the insured party’s representative and handle an insurance policy on their behalf is referred to as an agent of record, also known as a broker of record. Employers use agents of record as service providers so they don’t have to handle health insurance administration themselves.

What in the medical field is an AOR?

A person or business that represents an insured party on their behalf is known as an agent of record. It is legal for it to oversee insurance contracts on behalf of the other party. AORs are frequently hired by businesses to manage health insurance-related issues.

Conclusion

It’s critical to talk about the specifics of the agreement, such as their responsibilities, logistical specifics, and interpersonal elements, to guarantee a good AOR connection. Examining termination terms and conditions—including any fees or unstated expenses—is also crucial. Since they take on obligations and liabilities, it’s also critical to comprehend their liability and indemnity provisions. It’s critical to understand how they hold themselves responsible and how any infractions would result in settlements and compensations.

Read Also: