To determine their respective rights to payment from the borrower and to enforce security interests in the borrower’s collateral, two or more creditors of the same borrower may sign the Intercreditor & Subordination Agreement. These agreements enable borrowers to borrow more loans instead of issuing more equity if extra-secured debt is not available. If the borrower defaults, the junior lender consents to ground conditions safeguarding the senior lender. This essay will be written on the meaning, the importance of the intercreditor agreement, and a whole lot of other things.

To know more about intercreditor agreements, don’t stop reading.

What is an intercreditor Agreement?

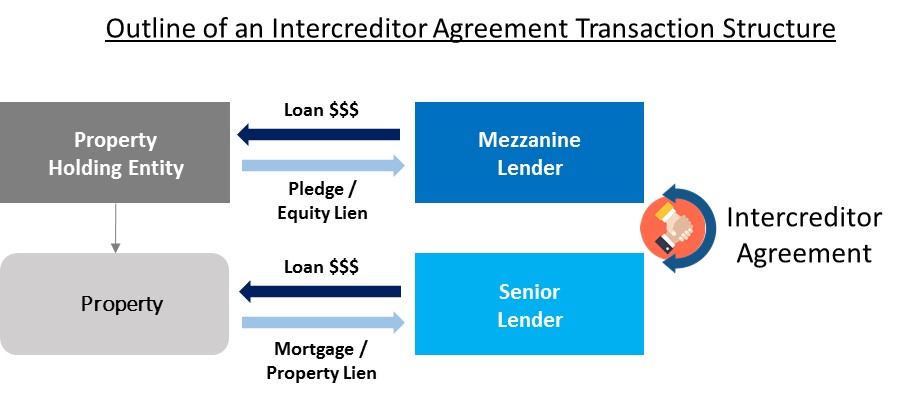

An intercreditor agreement (ICA) is a binding legal contract that exists between several lenders that are part of the same capital structure. The lenders must reach a consensus on the important matters of collateral, payment, lien subordination, debt caps, and remedies if the debtor defaults or files for bankruptcy because there are frequently multiple creditors in a single capital structure.

The intercreditor agreement mandates that the subordinate lender refrain from specific actions and prevents the borrower from making payments to the junior lender. These commitments are made between the senior and junior creditors. Lenders will differ in the kind and scope of these endeavors, and this is frequently negotiable.

What Does an Intercreditor Agreement Serve to Accomplish?

These agreements set the course of action that each lender may pursue and regulate the priorities among the lenders. The agreement typically outlines creditors’ priorities, payment methods, and legal enforcement methods for each charge. As an illustration, the second lender might require the original lender’s approval before initiating legal action against the borrower. Additionally, intercreditor agreements might specify what kind of borrowing is permissible against a given piece of property and whether the priority total is restricted or limited to either lender.

Is an Intercreditor Agreement Required?

When multiple creditors are involved in a transaction, a contractual agreement is likely necessary to outline the interactions between the parties involved in advancing payments to the borrower. To avoid any issues later in the process, this is done to ensure that the parties’ intentions are made known in advance. Before a junior lender can consider making up for their losses from the proceeds of the sale of the land or property, senior lenders in a commercial property transaction will frequently want an intercreditor agreement in place so that they can fully compensate their losses and frequently even earn interest on their investment.

As a Junior Lender, What Should I Be Looking for in an Intercreditor Agreement?

Given the senior lender’s stronger position, junior lenders should take care to ensure they understand the terms of the agreement. The conditions of intercreditor agreements are frequently set by senior lenders, which can cause problems in the future. Therefore, in order to be sure that the agreement is equitable for all parties, it is crucial that you have the correct guidance when putting these agreements up and that you fully grasp the rights it contains.

Importance of an Intercreditor Agreement

A crucial component of the right to the lien is an intercreditor agreement. The system establishes creditors’ rights and priorities in case of default and deteriorating financial situation caused by the borrower.

Conflicts could emerge if all parties use their rights simultaneously in the absence of such a convention. Credit events often lead to conflicts between creditors’ interests if there are insufficient assets to cover all liabilities. Therefore, before any such circumstance, each creditor’s rights are specified and protected by the intercreditor agreement.

Getting an Intercreditor Agreement Negotiated

Because there is frequently an imbalance of power, the senior lender sets the conditions of the lien in many agreements. Junior lenders may face a precarious situation if they fail to vigorously negotiate deals during a downturn.

A junior lender may have limited resources and may take longer to obtain clearance before completing a claim or agreement. Senior lenders may use this tactic to annoy junior lenders, so they agree to the agreed terms.

In project finance, the junior lender may negotiate terms to take over a borrower if they default, as their loss on default is greater than the senior lender’s.

The junior lender can either pay off the senior lender and discontinue the agreement, or it can inject more money to remedy the senior lender’s financial problems. With the latter, the junior lender effectively takes on the responsibilities of the senior lender and broadens their project exposure.

Take-out financing may become challenging if there is a major imbalance in the dynamic between the lenders, such as when the senior lender’s demands are “non-negotiable” or when the senior lender’s financing exceeds the junior’s capabilities.

Important Clauses in an Intercreditor Agreement

Age

explains the relative legal hierarchy (i.e., senior to subordinate, etc.) of different debts. It may also cover interest, fees, expenses, and indemnification payments, as well as any cap on the total amount of debt issued by each creditor. It grants one creditor preference over another.

Payback and Advance

Establish a hierarchy when allocating the borrower’s cash flow to the debt; for instance, principal and interest payments are made to the senior lender first. To facilitate repayment, the sequence—sometimes referred to as a waterfall—may include addressing the proceeds of collateral disposal and other recovery initiatives.

The text explains how a borrower’s inability to make payments to junior lenders can lead to the halting of repayments. Other safeguards include expedited debt repayment and other established legal procedures.

Collateral and Subordination

Explain the transfer of rights from one creditor to another over collateral that has been pledged, such as repayment priority. Seniority in debt may not always be more significant than certain rights.

A junior lender may be granted subordination of a senior creditor’s recovery rights over specific assets or collateral. The senior lender cannot use its repayment priority rights until the junior lender’s claim is fulfilled.

Voting Rights, Default, and Dispute Resolution

Create the enforcement structure that controls creditors, taking into account the dispute resolution process.. Standstill clauses, which forbid taking enforcement action, as well as other decision-making authority, might be included. Another example of enforcement power is the capacity to reorganize the borrower and its financial system.

There are significant differences in how voting rights are distributed. Current US case law[1] indicates that there is still uncertainty over the voting rights provision’s legality.

Information sharing is how financial performance and other specifics are made available to creditors through data rooms or other channels, preventing them from acting in a disorganized manner or lacking important, confidential information. Sharing provisions may require creditors to notify one another of any prospectively defined events.

Rights of Release and Termination

Specify when creditors may be modified and released from the Agreement, such as when a priority obligation is satisfied. Another conceivable application for provisions is to lessen the rights and duties of the parties.

An Intercreditor Agreement Is Drafted by Whom?

In addition to coordinating the entire financing process between creditors, the lead arranger or agent of the financing transaction is usually in charge of drafting the Agreement in collaboration with legal counsel. The lead arranger in less complicated transactions is usually the senior lender as well.. If there is a tight relationship between the borrower and the lenders or if the financing relationship is complex, the borrower may be involved.

Drafts are distributed so that each creditor can further negotiate and approve them. This undertaking becomes more complex the more creditors that are parties to the arrangement. Because each must follow their policies and processes, including any vetting by their (separate) legal counsel, the lead arranger’s involvement is essential.

FAQs

What Is the Purpose of an Intercreditor Agreement?

There is always a conflict between creditors’ interests when a credit event happens if there are not enough assets to pay off all debts. Therefore, prior to any such circumstance, each creditor’s rights are specified and protected by the intercreditor agreement.

How Do Agreements Between Intercreditors Operate?

An agreement between standard lenders is called an inter-creditor agreement. If the borrower defaults, it contains the terms and collateral allocation. Because it protects the rights of subordinate lenders, it is advantageous. Additionally, it outlines how their interests are protected from the average borrower.

What Is the Name of the Contract That Binds a Creditor and Debtor?

A debt agreement is a formal contract that settles an outstanding debt between a creditor and a debtor. When a debtor is facing bankruptcy and is unable to pay their entire debt, these agreements are utilized. A debt agreement gives a debtor the ability to bargain with a creditor to reduce the overall amount owed.

Conclusion

When there are multiple lenders in a capital structure, intercreditor agreements, or Icas, are essential legal papers. The Icas Play a Critical Role in Deciding How Lenders Can Continue to Collect Past Due Payments, Collect Interest, and Obtain Cash Consideration from Collateral Liquidations When Debtors Default or File for Bankruptcy.

Also, Read