A business that factors its invoices consents to assign its accounts receivable to the factoring company, which then has the authority to pursue payment for the invoices.

The document that notifies your clients of this change in ownership is the Notice of Assignment.

In addition to addressing these issues, this article describes the NOA’s operation, justification, and customer discussion tips. Continue reading to learn more.

A Notification of Assignment: What is it?

Within the factoring industry, using a NOA is customary and widespread. The customer’s accounts payable department receives it. As counseled by the NOA to the final client:

- A receivables management business is handling

- that the factor has received the funds from their invoicing

- A new address (often a bank lockbox) must receive that payment.

- Of additional components particular to the factor

This letter is crucial from the factoring company’s point of view. You sell your receivables’ intangible financial rights in an invoice factoring arrangement. Receivables are not physical commodities, so the NOA gives the factoring business permission to tell your clients that they have purchased the financial rights to the invoice.

What Does a Trucking Notice of Assignment Entail?

A Notice of Authorization (NOA) is a formal contract that notifies accounts payable that payments will be made to a different party than the invoice’s original owner.

When a broker is involved in trucking, the NOA notifies them of the trucking business’s affiliation with the factor and directs them to send all payments to the factoring company rather than the carrier that transported their load.

By law, the broker must reimburse the factoring firm for the amount of the invoice if it pays anyone else—including the carrier—other than the factoring company without getting written approval.

Factoring: What is it?

A trucking firm that buys reduced bills and sells them to a broker in exchange for an advance payment is known as a factoring company. After receiving the invoice and factoring the charge, the broker sends the remaining amount to the trucking business. Usually, the broker receives a notice of assignment.

An NOA Release Letter: What Is It?

When is a release letter from the NOA required? Following the dissolution of the factor-carrier business agreement, the factoring company sends a NOA release letter to the broker.

Typically short, NOA release letters could occasionally tell the broker where to send subsequent carrier invoice payments. The factor will give it to the broker if a new address is available for sending invoice payments. If not, it is only a notification that the commercial connection has ended.

What Effect Does NOA Have on the Company?

Business owners frequently worry about factoring because they think it can be a symptom of financial difficulties.

But it’s a sign of wise financial preparation, particularly in the face of stringent credit limits and lending standards. Debtors frequently value effective work procedures and the integration of factoring organizations’ accounting systems. Debtors can profit from working with a factoring company’s skilled accounts receivable team in several ways, such as:

Simplified procedure for accounts payable:

Numerous debtor businesses will already be collaborating with factoring firms. They are aware of a factoring company’s years of experience assisting businesses with collections and their proficiency in handling accounts payable and receivable procedures. Debtors find accounts payable to be simpler because of this professionalism and understanding of the invoicing procedure.

Debtors are aware that businesses employ invoice factoring to foster expansion, which is a positive thing:

In general, debtors view invoice factoring as a prudent financial tactic to increase cash flow because they are aware of its financial advantages. They would prefer to collaborate with a financially sound company than one that is having daily cash flow problems.

Strong customer service strengthens bonds with people:

Companies that consider invoices are aware of how crucial it is to keep a positive working relationship with consumers. Reputable factoring businesses are committed to providing the best caliber of knowledge and assistance to both their clients and their client’s customers. Both the factoring firm and the customer have a stake in maintaining and fostering positive connections on behalf of their clients.

Notice of Assignment: What is the Structure of Factoring Transactions?

One sort of finance that assists businesses experiencing cash flow issues as a result of delayed invoice payments is invoice factoring. The structure of factoring transactions differs from that of a traditional business loan. Alternatively, a company sells its accounts receivable to a factoring company in return for money.

A factoring company often purchases your receivables and pays for them in two installments. Not long after selling the invoices, you receive the first installment, known as the advance. Your company will receive instant cash flow from this installment. Usually, it pays for between 70% and 90% of the whole bill.

After your client pays in full, the factor deposits the remaining 10% to 30% that was not advanced, less the service charge, as a second installment. This subsequent payment completes the transaction.

Clients can employ factoring programs as often as necessary; they function like rotating lines.

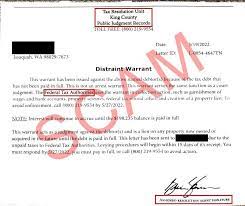

Examples of Notice of Assignment

One popular way that trucking companies finance their operations is through factoring. Businesses give a factor ownership of their accounts receivable, and the factor collects payments on their behalf. Customers receive notification of assignment from the factor detailing the assignment of the invoice and the necessary payment instructions.

Here is an illustration of a notice of assignment that a business could provide to its clients:

Date

Customer LLC

1o4 Main Street

Suite 100

Anytown, USA, 99000

Dear Sir/Madam

RE NOTICE OF ASSIGNMENT.

Dear Customer,

We are writing to let you know that ABC Factoring Company has been given your invoice number, 12045. Kindly send ABC Factoring Company the entire invoice amount to the following address:

AEE Factoring Company

1oo Main Street

Suite 100

Anytown, USA, 99000

By visiting www.abcfactoring.com, you may also make payments online. When paying, kindly remember to mention your invoice number. We highly encourage you to take notice of the change in payment details as you are responsible for any misdirected payments.

Please call 555-ooo-1234 to reach our office with any questions.

I appreciate your quick response to this issue.

Regards,

Name of Your Company

In Summary of Notice of Assignment:

Trucking firms employ a notice of assignment, which is an important document that notifies debtors of invoice assignment and provides payment instructions. It contains information about the amount, confirmed rate, due date, and mode of payment.

Trucking companies can benefit from factoring services provided by Advanced Commercial Capital, which promote company expansion.