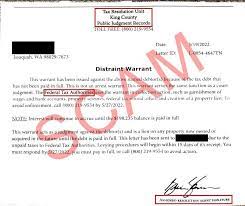

A phony organization known as the “Tax Resolution Unit” has been sending bogus “Distraint Warrants” to numerous local businesses through the mail. Although it appears that corporations are the main target of these letters, some individuals have also been sent them. Here are some crucial details concerning this distraint warrant scam, along with vital advice on how to protect yourself from such fraudulent operations, for the benefit of our community and the people we serve.

What is a Distraint Warrant?

Distraint warrants are a legally binding way to make sure that unpaid property taxes and liens from behind-the-time taxpayers are paid in the future. To safeguard the property owner’s assets from potential liquidation, the state may issue a warrant to enforce tax payment.

Do you have any outstanding taxes to pay before you lose your cool at the substantial amount of money the letter alleges you owe? If not, you must ascertain the legitimacy of the notice. Anytime you receive a letter requesting money of any kind, please exercise caution. This kind of mailing should never be taken at face value, even if it seems to be from a government organization! Conduct some research and also ake calls to or inquire with those you know to be legitimate sources.

The Scam

People and companies are duped into believing they are receiving official-looking documents in the mail from the Lucas County “Tax Resolution Unit” in this distrain warrant hoax. According to the document, the recipient is the target of a Distraint Warrant issued because of unpaid tax bills. The con artists take advantage of victims’ anxiety and sense of urgency to force them to pay immediately over the phone to a toll-free number. It’s important to remember that Lucas County lacks both an office of Public Judgment Records and a Tax Resolution Unit.

How to Identify It as a scam

- With this communication letter, there are a few RED FLAGS to be aware of:

- Why is the address for contacting the company that sent this letter missing?

- Which company is making an effort to collect this tax debt?

- “The Federal Tax Authorities employ this warrant for collection actions, including property seizures, wage and bank account garnishments, property offsets, federal tax return offsets, and property lien construction.” * Who are the Federal Tax Authorities?

- Which taxation body is in charge of collecting the unpaid tax debt?

- Why is the real amount of tax due not stated in the letter? and also

- Which tax period does the debt relate to?

How to Keep Yourself Safe from Distraint Warrant Scam

Check the source.

Every time you get a document that seems suspect, take a moment to confirm its legitimacy. To verify the validity of the warrant or notification, get in touch with the appropriate county agencies or law enforcement.

Be cautious.

Any unexpected or unwelcome correspondence about debts or taxes should be taken seriously. Reputable companies usually contact via formal channels and provide several chances to settle any disputes. Be wary of hurried or unexpected demands for payment.

Be Cautious with Your Data.

You should never respond to such inquiries by disclosing private or financial information that is too sensitive, like your credit card number, bank account information, or social security number. The IRS and also other legitimate authorities won’t contact you by phone or email for this information. The IRS will also not accept payments made by wire transfer, gift cards, or cashier’s checks.

Report the Fraud.

Notify the appropriate authorities right away if you come across a fraud or get a dubious paper. By visiting the US Treasury website or giving 1-800-366-4484, you can also report it to the IRS. Communities are frequently targeted all at once, so you might want to phone your local police to let them know about this scam. Finally, law enforcement agencies nationwide have access to the Federal Trade Commission’s Report A Fraud website. By reporting the scam, you can also help raise awareness of it and stop more people from becoming victims.

Raise Awareness

To help spread the word about the fraud, provide your friends, family, and coworkers with this information. Make use of social media, neighborhood associations, or any other venue that has a larger audience. Scammers find it increasingly difficult to succeed the more people are educated.

Distraint Warrant: FAQs

In Texas, what is a distraint warrant?

This warrant has the same purpose as an order from the court. The warrant is used by the State of Texas in collection actions, which include property seizures, wage and bank account garnishments, property lien construction, and offsets of federal tax refunds.

In the state of Washington, what is a distraint warrant?

A distraint warrant is a legal instrument that enables the tax collector to compel payment of the outstanding tax debt; it is not a warrant for your arrest. If the debt is still unpaid, further collection procedures may be initiated, which can involve property seizure and wage or bank account garnishment, among other things.

In Montana, what is a distraint warrant?

A warrant for distraint is an order issued to a Montana county sheriff or an agent designated by law to collect taxes, bearing the official seal of the Department of Transportation or revenue.

What is the duration of a warrant in Texas?

For what length of time are warrants valid in Texas? In Texas, warrants are active until they are fulfilled. When someone is taken into custody and posts a bond in connection with a case, warrants are typically cleared. In many cases, a lawyer in Texas can also assist in resolving a warrant or possibly getting it lifted.

Distraint Warrant: Conclusion

The awful “Distraint Warrant” scam, which is aimed at businesses and citizens in Lucas County, serves as a warning about the risks associated with fraudulent activity. However, we can all work together to prevent ourselves and our society from being victims of these scams by remaining watchful, confirming sources, and reporting suspicious situations.