When a homeowner passes away, they frequently desire to leave their house to their surviving spouse, children, or other loved ones without making them go through the probate court process. In California, there are multiple methods for setting the California Transfer on Death (TOD) Deed. Living trusts are a fantastic alternative, but they typically need a lot of paperwork and a lawyer.

A common solution is to include the heirs as joint tenants on the house’s title. This works, but because the kids become full owners right away, it can lead to several issues, such as higher taxes, creditor liens, and the inability to refinance or obtain a reverse mortgage. Continue reading to learn more about the advantages and disadvantages of the California Transfer on Death Deed, among others.

What Is Transfer on Death Deed?

The “Revocable Transfer on Death Deed,” sometimes referred to as the “TOD Deed” or “beneficiary deed,” is an easy way to give your beneficiaries a house without going through probate. The intended heirs are designated as “beneficiaries” by the present owner, or “transferor.” You can decide to sell the property, refinance, or change your mind at any time because the deed is void until the transferor passes away. When you pass away, your beneficiaries inherit your property without having to go to court; but, they must notify all of your heirs and file or record several documents.

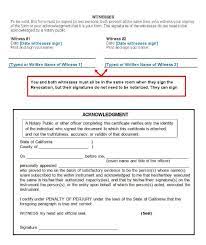

Upon the donor’s passing, the beneficiaries will need to notify all heirs and file several documents. TOD deeds will require two witnesses to sign them as of January 1, 2022.

Advantages of Transfer of Death (TOD) Deed

- Prevents probate, if certain conditions are met, such as beneficiaries dying before transferor and no unforeseen family changes;

- Easy, low-cost substitute for a living trust or other methods of avoiding probate;

- Is revocable at any point in the transferor’s lifespan;

- The same tax benefits apply to inheritances made under a will or a trust.

Disadvantages of Transfer of Death (TOD) Deed

- Simple but stringent technical requirements exist, and mistakes can render the TOD deed null and void;

- Your obligations do not shield the house from them. You might leave nothing to your beneficiaries if you pass away with a mortgage or other debt;

- When you pass away, the other owner inherits your portion of the property if you co-own it as community property with the right of survivorship or joint tenancy. If you outlive your co-owner, the TOD deed is nullified. Co-owners must each sign a separate TOD deed to use one;

- Because they fear the TOD deed will be contested, title firms may decline to provide title insurance for three years following your passing, preventing sales or refinancing of the property;

- A beneficiary’s portion will not pass to their heirs if they pass away before the transferor. Rather, the remaining recipients share it. If no beneficiaries live, your home will probably need to go through probate;

- The beneficiaries will need to take certain actions to transfer the property after your passing, such as alerting potential heirs so they can contest the TOD deed.

How to Fill And Record a Transfer on Death Deed in California

Correct completion and recording of the TOD deed form is essential. TOD needs a highly particular language to be effective. Should any prerequisites be omitted or misinterpreted, your deed can be deemed invalid or yield unexpected outcomes. Among the requirements are:

- Each owner is required to complete their own TOD deed. For example, a married couple would have to complete and record two different TOD deeds.

- A notary must sign each form.

- Two witnesses must sign each form.

- After the TOD form is signed and notarized, it needs to be registered within sixty days.

- Your name and the description of the property must exactly match those on the title documents.

- The beneficiaries must be listed by name. You could say how they are related to you.

Important details on the deed’s effect, its application, and your ability to revoke it if you change your mind are all included in the deed form. Make sure you understand what you are signing as usual. Don’t sign if you are under any pressure to do so! Speak with a different relative or perhaps the district attorney.

Is Transfer on Death Deed Revocable?

Yes, you can record and notarize a revocation of a revocable transfer on the death deed to withdraw your TOD deed at any time. This form resembles the TOD deed itself quite a bit. It is also only valid if it is documented before your death and has the signatures of two witnesses.

How Do the Beneficiaries Get the Property?

There are some guidelines that your beneficiaries need to adhere to. Any heirs at law must be notified; if you received benefits from Medi-Cal, they must also tell Medi-Cal and notarize and record an Affidavit of Death of Transferor under TOD Deed, along with a death certificate. They then take ownership, barring any objections from any legal heirs.

The other owner will inherit your portion of the property upon your passing if you co-own it as community property with the right of survivorship or as joint tenancy. Unless you outlive your co-owner, the TOD deed is meaningless.

Rather than Using a Tod Deed Why Not Make Your Heirs Joint Tenants?

A common strategy to avoid probate is to name your heirs as joint tenants on the deed. This is effective, but it can lead to major issues that the revocable TOD prevents.

Revocable at any moment

Your intended beneficiaries become the immediate complete legal owners thanks to the joint tenancy deed. The revocable transfer on the death deed is revocable at any moment. A deed of joint tenancy is irrevocable.

The property is still yours.

Depending on your circumstances, adding owners may result in several issues, such as difficulties selling or refinancing, liability for their debts, an acceleration of your mortgage (100% due now), loss of control over the property (e.g., unwanted roommates or eviction), significantly higher property taxes, changes to who inherits your property, and more.

These issues are avoided since the beneficiary or TOD deed does not grant the heirs any instant rights to the property.

FAQs

In California, is it still possible to transfer a death deed?

In 2022, a beneficiary of a Transfer-on-Death deed is mandated by law to notify all heirs of the deceased party about the original owner’s passing. The communication must include a copy of both the Transfer-on-Death deed and the death certificate.

In California, does a TOD escape probate?

An owner of residential real estate can designate one or more beneficiaries to inherit the property upon their death by using the new transfer on death (TOD) deed. Probation is not required while using this procedure.

Are Tods allowed in California?

A TOD deed can be used to transfer any of the following kinds of real estate in California: property with between one and four homes on it. a condominium or a 40-acre or less tract of agricultural land with a single-family home on it.

In California, who gets property after death?

The appointment of a personal representative is subject to a priority order if the nominated individual in the will is unable to act or if there is no will at all. Any surviving spouse or domestic partner comes first, followed by a kid, a grandchild, a parent, and finally a sibling.

Conclusion

A shared tenancy allows you to keep your ownership interest while granting another individual a current ownership interest. If they are helping you pay for the property, for instance, or if they are residing there and you wish to formally recognize them as owners, you might consent to include them.