The U.S. amended the Securities Exchange Act of 1934 and Rule 12b-2, defining “accelerated filer” and “large accelerated filer.” Securities and Exchange Commission (“Commission”) through a vote on March 12, 2020. The amendments aim to protect investors, promote capital formation, and reduce compliance costs for smaller issuers while preserving capital. Knowing the large accelerated filer requirements helps a lot.

If you want to know more about Large accelerated filer and its requirements, this article

Large Accelerated Filer: What Does It Mean?

A big accelerated filer is an issuer that meets certain requirements at the end of its fiscal year.

(i) As of the last business day of the issuer’s most recently completed second fiscal quarter, the issuer’s total worldwide market value of the voting and non-voting common equity held by its non-affiliates was $700 million or greater;

(ii) The issuer is obligated to comply with Section 13(a) or Section 15(d) of the Act for a minimum of twelve calendar months.

(iii) Under section 13(a) or section 15(d) of the Act, the issuer has submitted at least one annual report;

The accelerated filing status of a business ought to be reassessed annually as of the conclusion of its fiscal year.

A type of reporting company known as a large accelerated filer has noticeably lower deadlines for filing their periodic reports.

Large Accelerated Filer: Amendments

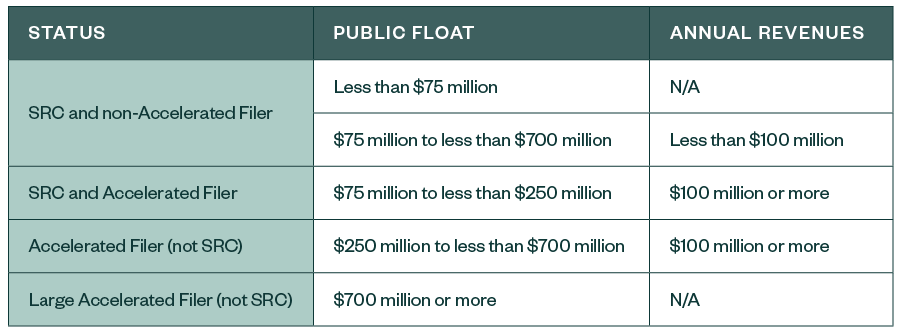

The standards that a corporation must meet to be classified as a big accelerated filer are outlined in Securities and Exchange Commission (SEC) Rule 12b-2. A major accelerated filer is a company with a public float of at least $700 million, publishing periodic reports for at least a year, and filing at least one annual report.

A corporation has 60 days to file its Form 10-K and 40 days to file its Form 10-Q after meeting Rule 12b-2’s criteria.

Results Of The Amendments

The amendments will allow low-revenue issuers to avoid Section 404(b) of SOX, which mandates an independent auditor’s attestation and reporting of their management’s internal control assessment. Nonetheless, such issuers will still be responsible for several tasks, including creating and maintaining ICFR and having management evaluate it under SOX Section 404(a). The modifications include adding an ICFR auditor attestation check box to Forms 10-K, 20-F, and 40-F cover pages. It also involves adjusting transition thresholds for big and expedited filers.

When Do the Amendments Need to Be Implemented?

The annual report submissions due on or after April 27, 2020, will be subject to the aforementioned changes. To ascertain its status as a non-accelerated, accelerated, or large accelerated filer, the issuer may apply the modifications. Even if the annual report pertains to a fiscal year that concludes before the effective date.

Large Accelerated Filer Requirements

A type of reporting company known as a large accelerated filer has noticeably lower deadlines for filing their periodic reports.

SEC Rule 12b-2 outlines the standards a corporation must meet to be classified as a big accelerated filer. The company must meet certain criteria to be eligible, including having a public float of at least $700 million. The company must publish periodic reports for at least a year, file at least one annual report, and not be a smaller reporting company. A major accelerated filer is one with a public float exceeding $700 million.

A corporation has 60 days to file its Form 10-K and 40 days to file its Form 10-Q. But it is after meeting Rule 12b-2’s criteria.

FAQs

Which Businesses Are Significant Expedited Filers?

A large accelerated filer, as per the latest fiscal quarter’s public float, is a reporting company with a public float of $700 million or more.

A Huge Accelerated Filer 2023 Is What?

As of the last day of its most recently completed second fiscal quarter, a Large Accelerated Filer has a public float of at least $700 million, has been subject to the Exchange Act’s Section 13(a) or 15(d) reporting requirements for at least 12 months, and has filed at least one annual report.

For Whom Is a Non-accelerated Filer Eligible?

If the company’s revenue is less than $100 million, it will not be considered an expedited filer. It will be an expedited filer if its revenues reach $100 million or above.

Conclusion

An accelerated filer can become an SRC if its revenue is less than $80 million and its public float is less than $560 million.

When an accelerated filer’s revenue drops below $80 million, they qualify as an SRC under the SRC revenue test. However, according to the revised guidelines, an accelerated filer that meets the public float test criteria is an SRC. The company has less than $250 million in public float and may become a non-accelerated filer if its yearly revenues drop below $100 million.

Also, Read