The FFCRA and CARES Act provide federal relief to businesses affected by the pandemic, enabling them to claim advance employer credits on their tax returns.

This post will describe the Form 7200, Erc Form 7200, and Form 7200 employee retention credit instructions and how your small business might benefit from them. Continue reading!

Form 7200: What Is It?

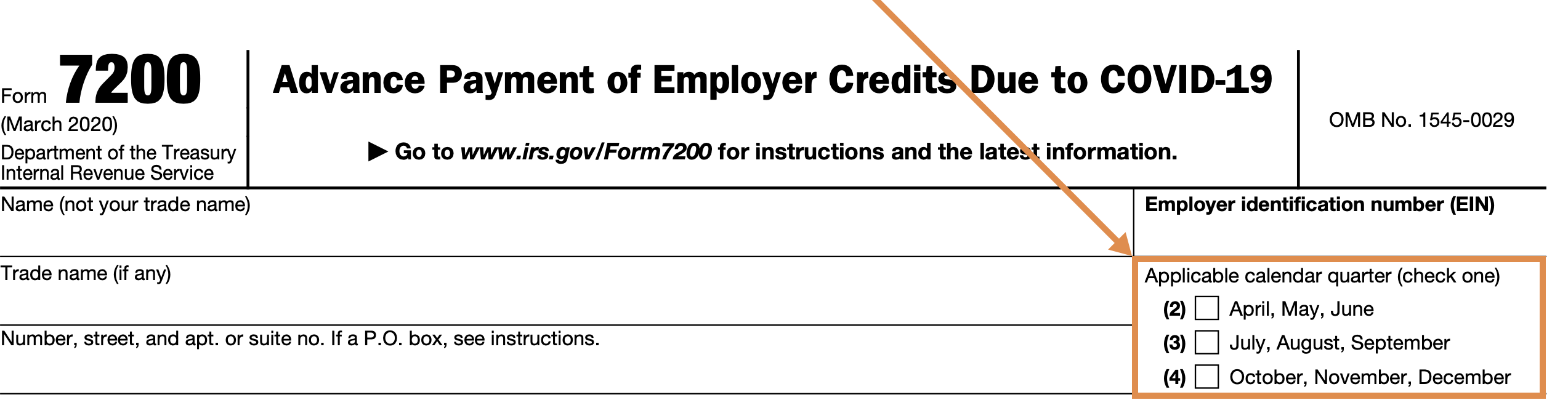

Form 7200: Employer Credits Advance Payment Due to COVID-19, you must request the tax credits in advance for qualified sick and family leave wages, as well as the employee retention credit, which you will have to file on employment tax forms such as Form 941, Form 941-PR, Form 941-SS, Form 943, Form 943-PR, Form 944, Form 944(SP), and Form CT-1.

What is Form 7202, IRS?

The Family and Medical Leave Act (FFCRA) provided self-employed taxpayers with equal refundable credits. These taxpayers use Form 7202 to calculate the amount of eligible sick and family leave equivalent credits.

IRS Form 7200: What is it?

Eligible firms can apply for employee retention credit in advance from the IRS using Form 7200. It addresses claims on several employment tax return forms, such as Form 941, quarterly employment tax, and employer relief credits for paid time off for illness or qualifying family leave.

For instance, an employer must deposit a total of $10,000 toward retention taxes. They are eligible for credits totaling $8,000. As a result, on the following regular deposit day, the employer would only need to contribute $2,000.

Form 7200, Employee Retention Credit: What Is It?

Due to government orders or reduced gross receipts, businesses and tax-exempt organizations that continued to pay their employees during the COVID-19 outbreak are eligible for a tax credit called the Employee Retention Credit (ERTC).

When is the Form 7200 deadline for submission?

Owners of businesses may apply for anticipated credit at any time during the month that follows. The quarter in which they paid the eligible wages But the following cutoff dates are relevant:

- August 2, 2021, for qualifying earnings received during the 2021–2022 second quarter.

- November 1, 2021, for eligible earnings received during the 2021 third quarter.

- For the fourth quarter of 2021, the deadline to file Form 7200 to seek an advance employment tax return is January 31, 2022.

How to Fill Out IRS Form 7200: Guidelines

- Put in Your Company’s Details

- Your Tax Returns as an Employee

- Enter the requested advance and your credits.

- Please indicate whether you have a third-party designee.

- Seal the authorization document.

What Typical Mistakes Must I Steer Clear Of While Completing My Form 7200?

- Inaccurate or absent EIN

- Choose from many calendar quarters

- Lines 4, 7, and 8 in Part 2 of the form have incorrect calculations, and

- The signature section is missing.

How much time does it take to process applications for advanced tax credits?

The processing of Form 7200 requests is not subject to a time limit. Form 7200 may not be processed before Form 941 for that period is filed, albeit, if it is filed after the quarter has ended. The IRS will notify you via Letter 6312 if they are unable to process your request for whatever reason.

FAQs:

Which Form 7200 amendments apply to the Second Quarter of 2021?

The IRS has modified the Form 7200 for the second quarter of 2021. Q2 2021 sees the following lines modified or added:

- Line B: The total number of workers who are eligible for the employee retention credit this quarter and who are receiving qualified wages should be entered here.

- Line G: Indicate how many people helped with COBRA premium assistance for the requested advance during the quarter.

- Line H: If the company is qualified for the employee retention credit only because it is a recovery startup, check this box.

- Line 4: Enter the total amount of this quarter’s COBRA premium assistance.

Who has to submit Form 7200?

To get advance payment of tax credits for eligible sick leave, family leave wages, and employee retention credit, employers must fill out Form 7200; however, for 2021, Form 7200 filing is not necessary.

Is Form 7200 Correctable?

You cannot file a corrected Form 7200 after you have already filed the original. As you file your employment tax Form(s) 941, 943, 944, or CT-1 for 2021, any errors you discover on Form 7200 will be fixed.

FFCRA: What is it?

The US government launched the Families First Coronavirus Response Act (FFCRA) as an emergency measure in response to the coronavirus’s effects on US companies and labor forces.

In Brief:

If any information is missing, inaccurate, or incomplete, the IRS may deny your request for an advance payment of credits, so double-check everything.

Also, Read:

Can my family revoke my advance directive?

How To Buy A House In Texas In 2022: Step By Step Guide